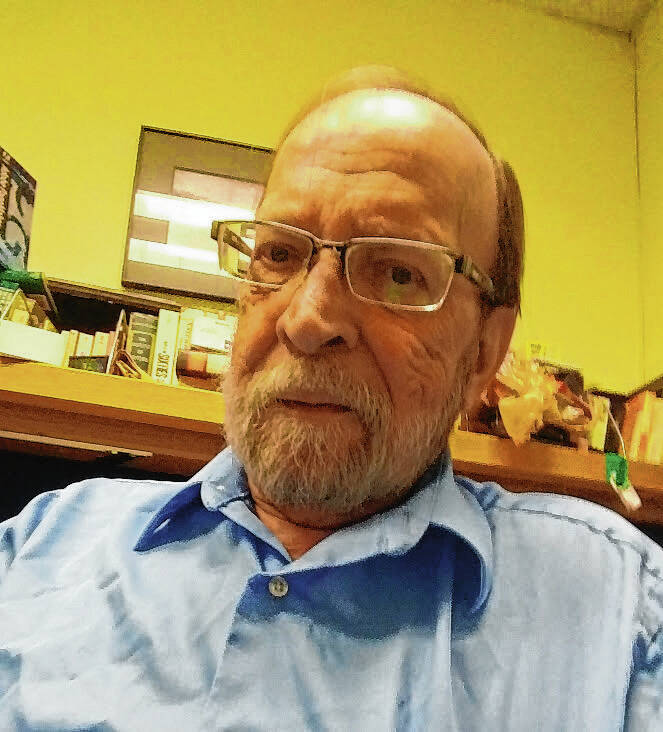

Leo Morris

Several years ago, I finished a nice meal at one of my favorite restaurants and settled up with the waitress, someone new to the place.

“Oh, thank you,” she gushed. “Thank you so much!”

“For what?” I asked, puzzled at her exuberance. “It’s just a standard 20% tip.”

“But this is such a 10% town,” she replied.

Ah, memories.

Considering everything that has been happening lately, if that incident happened today, it would have undoubtedly been a “standard 25% tip” and the waitress would have disparaged Fort Wayne as a “15% town.” And I would have felt compelled to tip the hostess on the way in and the parking lot attendant on the way out.

Tipping has clearly gotten out of hand, as numerous news analyses have pointed out recently. The inflationary trend (both of whom and how much to tip) began years ago but accelerated greatly during the COVID-19 pandemic.

One of the main culprits, apparently, is the proliferation of apps that have popped up, both on our smartphones and inside many establishments, that have removed human contact from our grubby little financial transactions. A swipe here and the tap of an icon there and – bingo, zingo – we have placed our order and paid for it without risking instant death from loathsome strangers’ nasty exhales.

And those apps all have little push prompts suggesting a range of tips and nagging us about how much we would like to leave, even at times and in places where we had never considered tipping before. Customers thus feel pressured to tip more than they normally would, according to creditcards.com.

“They use those options as an indication of what the normative range is and feel compelled to tip within that range,” Mike Lynn, a professor of consumer behavior and marketing at Cornell University, told CNBC. “So the more you ask, the more you get.”

Actually, I think it is more insidious than that. The merchants are helping us forget we are actually spending money, and the more we forget, the easier it is for us to give up more of it.

When we paid actual cash for things – you remember, that green, folding stuff – we knew we were parting with the chits we got for our hard-earned labor and that we should be careful of how we disposed of them. Then we started using checks, one step removed from cash. Then came credit cards and debit cards, one more step away.

Finally, those apps, and all we are doing is moving numbers across a screen that bear no relation to our real lives. We don’t even think of it as real money until perhaps the end of the month when we wonder where in the world it all went to.

It’s a lesson the private sector has learned all too well from the government.

The most inspired – touched with mad genius, even – move by the federal government was paycheck withholding for the income tax. Losing just a portion of the total owed each pay period lulls taxpayers into ignoring just how much we are giving up. It’s money we never see, so it was never really ours, right?

Of all of the causes of the federal government becoming the profligate behemoth it is, that’s the main culprit. If we ever hope to really tame that beast, just do one simple thing. Stop the withholding and present taxpayers with a yearly bill instead. Heads will roll, and change will come.

In the meantime, we can wax nostalgic for days gone by when tipping was 10%, confined to a few dining experiences a year, and we were guilt-tripped into doing it with visions of brave and struggling below-minimum-wage mothers and their half-starved children.

And of a time when government pledged to do and spend the minimum required to fulfill its legitimate functions, and we all believed it.

Leo Morris, a columnist for Indiana Policy Review, is winner of the Hoosier State Press Association’s award for best editorial writer. Morris, as opinion editor of the Fort Wayne News-Sentinel, was named a finalist in editorial writing by the Pulitzer Prize committee. Contact him at [email protected].