Mickey Kim

By Mickey Kim

Guest columnist

I don’t know what a “normal” election is anymore, but the 2024 race for the White House has been particularly volatile due to a series of extremely low-probability events. In just the past several weeks there have been not one, but two assassination attempts on a former president running for office again. A sitting president dropped out of the race. A member of a Democratic family dynasty (Robert F. Kennedy, Jr.) dropped his own candidacy and endorsed a populist Republican (Donald Trump).

Nobody knows what other surprises might come out of left field, but with just over a month until the election, it’s time for investors to prepare themselves mentally for the impending political storm. I never make predictions, particularly in writing, but it’s a sure bet the vitriol and partisan political assault we’re all going to be bombarded with over the next few weeks will be mind-numbing.

As the partisan storm increases in intensity over the coming months, you may be tempted to make changes to your portfolio because of how you believe a short-term event such as an election will impact the financial markets. Don’t. Making an anxiety-based change because of your political beliefs will be harmful to the long-term health of your portfolio.

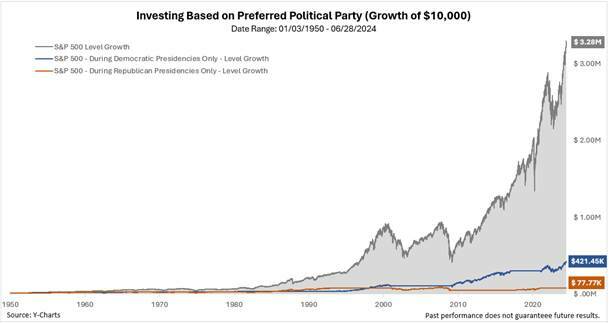

It’s been said “a picture paints a thousand words,” so I have a great one to share from Y-Charts.

Both Democrats and Republicans predict Armageddon if the other is elected, so it may seem logical to only invest when “your” party occupies the White House. According to Y-Charts, if you invested $10,000 in the S&P 500 on Jan. 3, 1950, and left it alone, on June 28, 2024 (almost 75 years later) you would have had $3,278,000. If, however, you were only invested during Democratic ($421,450) or Republican ($77,720) administrations over the same period, you would have had dramatically less (87% less with Democratic-only and 98% less with Republican-only). Clearly, letting partisan passions control your investment decisions can be very costly.

Today’s problems may seem new and insurmountable. Invesco provided an interesting civics lesson based on a Gallup Poll asking people what they thought was the most important problem facing the country. On the “economic” side of the ledger, respondents cited the economy in general, high cost of living/inflation and Federal budget deficit/debt were cited. The “non-economic” side included immigration, poor leadership and unifying the country.

Those problems and issues are well known, so the responses were not particularly interesting. What is interesting is what some of our forefathers had to say about the same issues.

“Public debt is a public curse.” — James Madison

“(Inflation is) a gradual tax upon them.” — Benjamin Franklin

“(Immigration) has served very much to divide the community.” — Alexander Hamilton

“Democracy never lasts long. It soon wastes, exhausts and murders itself.” — John Adams

“The distemper in our nation is…certainly incurable.” — George Washington

Mark Twain famously said, “history never repeats itself, but it often rhymes.” Develop an investment plan based on your long-term goals and stick to it. Your financial future will depend far more on how much you save and invest, not who wins the election.

Mickey Kim is the chief operating officer and chief compliance officer for Columbus-based investment adviser Kirr Marbach & Co. Kim also writes for the Indianapolis Business Journal. He may be reached at 812-376-9444 or [email protected].